Venezuela’s Economic Offensive: An End to the Unrest?

This May, Venezuelan president Nicolás Maduro announced several fiscal strategies intended to resuscitate the country’s struggling economy. The measures, including the issuance of new government bonds and contracts with petroleum extraction partners, come on the heels of Sicad II, a new floating exchange rate that represented a de facto devaluation of the bolivar—the first in four years. [1] President Maduro’s administration refers to these measures as an “Economic Offensive,” intended to “reactivate productive processes in order to guarantee just prices and supply.” [2]

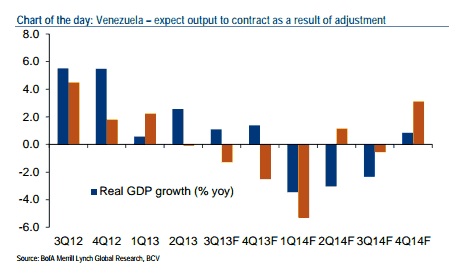

Dramatically titled in typical Bolivarian fashion, the Economic Offensive is essentially a package of micro- and macroeconomic adjustments. These adjustments, however, could indeed have a dramatic impact on Venezuela’s economy. According to Bank of America’s Andean Economist Francisco Rodriguez, they should lead to economic stabilization in the coming months. [3]

Moreover, although Rodriguez and other analysts doubt the long-term desirability of stability without growth, the Economic Offensive should lead to a reduction in shortages and inflation, thereby resolving some of the key drivers of the unrest that began in February. Hardline opposition groups are bound to remain unsatisfied, but the much-needed adjustment should appease the majority of Venezuelans who are mainly concerned with the economy. [4] The Economic Offensive and the resultant economic stability are very likely to ease the tense political situation in Venezuela by late 2014.

The Economic Offensive Takes Shape

Crude and refined petroleum account for over 96 percent of Venezuela’s exports and 45 percent of its budget revenue. [5] However, petroleum production has remained largely stagnant in recent years, with a slight drop in production since 2011. [6] The government has made increasing production a key element of the Economic Offensive, signing a spate of larger contracts with partner extraction firms during May. [7] Contracts with Halliburton, Schlumberger, and Weatherford International total $2.2 billion USD and include $1.2 billion USD in new deals. These contracts brought the total amount borrowed by state-owned oil company PDVSA to $13 billion USD since 2012. [8]

Energy Minister Rafael Ramírez said that PDVSA will invest $24 billion USD to increase production this year, also indicating plans to escalate natural gas extraction via new contracts with Repsol, Eni, Petrobras, and Williams. [9] Although many analysts have pinpointed excessive borrowing as a flaw in Venezuela’s economy, increased hydrocarbon investment should boost government oil revenue in the long term, ultimately reducing the need for high-interest foreign loans. Hydrocarbon extraction generally proves to be a high-return investment.

In addition to revving up hydrocarbon production, on May 14, PDVSA issued $5 billion USD in government bonds in a move to raise the domestic availability of hard currency in dollars. [10] Although Venezuela issued a comparable amount of domestic bonds last year, this is the first time it has done so on the international market since 2008. [11] Caracas daily El Universal also publicized a government roadshow to investment houses in New York and London, further hinting at an increasing external orientation within the Maduro administration. [12] In addition to bringing a dollar influx, the bond issuance reflects an attempt to improve Venezuela’s reputation on international finance markets. The move seems to have worked. Russ Dallen of Caracas Capital Markets reported a healthy demand for the $5 billion USD in bonds. [13]

The most important piece of the Economic Offensive is Sicad II, a new foreign exchange (FX) mechanism implemented on March 24. Sicad II is Venezuela’s third official FX mechanism, complementing a fixed government rate used to import food and medicine at 6.3 bolivars per dollar, and Sicad I, a fixed general rate of 10.8 bolivars per dollar. [14] However, unlike the other two FX mechanisms, Sicad II is a floating rate, which better approximates the true value of the bolivar. It debuted at 51.86 bolivars per dollar and has fluctuated around 50 ever since. [15] In comparison, the black market dollar rate rose to 87.9 bolivars per dollar before Sicad II, and has since stabilized around 70. [16]

While Sicad II only covered seven to eight percent of Venezuela’s FX market at opening, it appears that Caracas hopes to ease into a de facto devaluation of the bolivar by slowly applying the Sicad II rate to an increasing number of sectors. [17] Such an approach favors gradualism over shock therapy, with the goal of easing the painful side effects of deregulation. Ideally, the government seems to expect that the bond issuance will provide short-term cash flow for the process, while increased hydrocarbon production will do so in the long term.

An initial example of this process took place on March 26, when Caracas reached deals with six foreign airlines to pay off $3.9 billion USD in debt, as well as shifting airline tickets to the Sicad II FX rate. [18] As Francisco Rodriguez outlines, this likely will cause a contraction in the sector as middle- and upper-class Venezuelans are no longer able to benefit from artificially cheap ticket prices. [19] However, it also should lead to stability, as the bloated demand for cheap dollars will no longer exist in the sector. As the government applies Sicad II to other sectors, the same process should repeat itself, bringing stability (but also contraction) to the economy as a whole.

Economic Impacts

While most analysts agree that the Economic Offensive will lead to increased stability, many disagree on the broader significance of this change. Francisco Toro, a vocal critic of Maduro and Chavismo, argues that stability without growth does not produce prosperity. According to Toro, the fact that the government is “slowly doing things likely to curb the chaos of shortages, inflation and uncertainty [that did] so much to fuel protest this year… does not mean chavismo (sic) is taking effective steps to make people more prosperous.” [20] Toro also criticizes the implementation of Economic Offensive policies, arguing that Caracas should abandon the slow transition to Sicad II in favor of a shock therapy-style “jump” into the Sicad II rate. [21]

On the other hand, Mark Weisbrot of the Center for Economic and Policy Research maintains that Sicad II represents an important step in the right direction by rectifying the exchange rate system, which he terms “the most important economic problem… in Venezuela.” [22] Weisbrot, a general supporter of Bolivarianism, argues that, by “drawing currency exchanges away from the black market, and putting a circuit-breaker into the inflation-depreciation cycle that we have seen over the last year or so,” Sicad II will begin to bring down inflation and resolve shortages. [23]

Francisco Rodriguez of Bank of America occupies the middle ground. He concurs with Toro that “in order to generate sustainable increases in living standards, Venezuela would have to tackle the reform of some of those microeconomic distortions that have held down its productivity growth.” [24] However, he continues, “stabilization does imply an improvement in key macroeconomic indicators.” [25]

Social and Political Impact

Despite differing assessments of the long-term implications, all of these analysts agree that Sicad II (and, by extension, the Economic Offensive as a whole) is very likely to stabilize Venezuela’s economy in the near future. Regardless of the developmental value of this change, stabilization would have a palpable social and political impact, particularly on the unrest and street protests that began in February. According to the most recent poll by Venezuelan firm Hinterlaces, 44 percent of middle class Venezuelans believe the economy represents the gravest problem at hand. [26] However, stabilization and the resultant reduction in shortages and inflation should do much to assuage these common concerns.

Many sources have documented the fact that middle and (especially) upper classes are driving unrest in Venezuela. [27] Others have recognized that a hardline faction of the ultra-right is driving the guarimbas and violent protests, while the larger marches tend to consist of mostly peaceful and moderate groups. [28] However, most mainstream sources have conflated the two factions of the opposition. Those informed only by such sources might think that economic improvements would do little to pacify such vehement upheaval. Such analysis, however, misses the point that most protestors are not fervently antigovernment, but simply are upset with the country’s economic struggles and instability.

Based on the forecast of economic stability and the popular focus on the economy, the Economic Offensive should largely pacify much of the opposition, leading to a significant reduction in pressure on the Maduro administration in coming months. Of course, an economic uptick will not singlehandedly resolve the profound political polarization that seems endemic in Venezuela.

Despite a reduction in protestor numbers since late April, much concern remains over non-economic issues, including human rights, civil liberties, and police brutality. The opposition coalition Mesa de la Unidad Democratica (MUD) froze dialogues with the government on May 14, and UNASUR moderators have thus far been unable to facilitate the resumption of talks. [29] The possibility of U.S. sanctions, which are gaining momentum after approval in the House of Representatives on May 28, adds further uncertainty to the situation. [30] While the bill’s sponsors maintain that sanctions would support the opposition, several analysts have proposed mechanisms through which U.S. sanctions could in fact improve the government’s position. [31]

In sum, the Venezuelan political climate remains heated and unpredictable, and the country’s economy is only one of many factors influencing the unrest. Maduro’s Economic Offensive is no panacea for Venezuela’s government or its people—the Bolivarian project thus far seems to be an inextricably polarizing form of societal organization. Nevertheless, the Economic Offensive will likely remove the primary grievance of a substantial portion of the protestors. While it is too early to predict an end to the unrest, Venezuela appears to be on the path toward stability.

Please accept this article as a free contribution from COHA, but if re-posting, please afford authorial and institutional attribution. Exclusive rights can be negotiated. For additional news and analysis on Latin America, please go to: LatinNews.com and Rights Action.

References

[1] Kurmanaev, Anatoly, Corina Pons and Katia Porzecanski. “Venezuela Lets Bolivar Depreciate 88% on New Sicad II Market.” Bloomberg. 25 March 2014. http://www.bloomberg.com/news/2014-03-24/venezuela-to-start-trading-dollars-for-first-time-in-four-years.html

[2] Bastidas, Yorcellys. “Vicepresidente Arreaza destaca resultados positivos de las fiscalizaciones económicas.” Correo del Orinoco. 21 May 2014. http://www.correodelorinoco.gob.ve/nacionales/vicepresidente-arreaza-destaca-resultados-positivos-fiscalizaciones-economicas/

[3] Rodriguez, Francisco. “Venezuela in Focus: the Adjustment View.” Bank of America strategy paper. 7 May 2014. https://docs.google.com/a/coha.org/file/d/0BwJa4qkRMTYSQVY0cEg5RUg4S00/edit

[4] Dutka, Z.C. “Polls Reveal Wider Concerns of Venezuelan Public” Venezuelanalysis. 12 May 2014. http://venezuelanalysis.com/news/10679

[5] Central Intelligence Agency. The World Factbook: Venezuela. Last updated 1 May 2014. https://www.cia.gov/library/publications/the-world-factbook/geos/ve.html

[6] Ministerio del Poder Popular de Planificación. Informe Económico Semanal. 16 April 2014. Slide 68. http://www.abc.es/gestordocumental/uploads/Internacional/Informe_Economico_Venezuela.pdf

[7] Rosas, David. “Pdvsa firma acuerdo de 2 mil millones de dólares con trasnacionales para incrementar la producción petrolera.” Correo del Orinoco. 21 May 2014.http://www.correodelorinoco.gob.ve/nacionales/pdvsa-firma-acuerdo-2-mil-millones-dolares-trasnacionales-para-incrementar-produccion-petrolera/

[8] “Créditos pactados por Pdvsa se elevan a $13 millardos.” El Universal. 22 May 2014. http://www.eluniversal.com/economia/140522/creditos-pactados-por-pdvsa-se-elevan-a-13-millardos

[9] “Venezuela: The Mother of all Adjustments.” Latin News. 22 May 2014. http://www.latinnews.com/index.php?option=com_k2&view=item&id=60713&uid=55646&acc=1&Itemid=6&cat_id=794886%20

[10] Ellsworth, Brian. “UPDATE 1-Venezuela’s PDVSA issues $5 bln 2024 bond.” Reuters. 14 May 2014. http://www.reuters.com/article/2014/05/14/venezuela-pdvsa-bonds-idUSL1N0O015C20140514

[11] Ibid.

“Venezuela: The Mother of all Adjustments.” Latin News. 22 May 2014. http://www.latinnews.com/index.php?option=com_k2&view=item&id=60713&uid=55646&acc=1&Itemid=6&cat_id=794886%20

[12] Salmerón, Victór. “Gobierno prepara road show en Nueva York y Londres.” El Universal. 22 May 2014. http://www.eluniversal.com/economia/140522/gobierno-prepara-road-show-en-nueva-york-y-londres

[13] llsworth, Brian. “UPDATE 1-Venezuela’s PDVSA issues $5 bln 2024 bond.” Reuters. 14 May 2014. http://www.reuters.com/article/2014/05/14/venezuela-pdvsa-bonds-idUSL1N0O015C20140514

[14] Kurmanaev, Anatoly, Corina Pons and Katia Porzecanski. “Venezuela Lets Bolivar Depreciate 88% on New Sicad II Market.” Bloomberg. 25 March 2014. http://www.bloomberg.com/news/2014-03-24/venezuela-to-start-trading-dollars-for-first-time-in-four-years.html

[15] Ibid.

“Tasa del Sicad II cerró la jornada de este viernes en Bs. 49,97 por dólar.” Correo del Orinoco. 30 May 2014. http://www.correodelorinoco.gob.ve/nacionales/tasa-sicad-ii-cerro-jornada-este-viernes-bs-4997-por-dolar/

[16] Weisbrot, Mark. “SICAD II is Important Step Toward Resolving Exchange Rate Problem in Venezuela.” Center for Economic and Policy Research. 6 April 2014.http://www.cepr.net/index.php/op-eds-&-columns/op-eds-&-columns/sicad-ii-is-important-step-toward-resolving-exchange-rate-problem-in-venezuela

[17] Kurmanaev, Anatoly, Corina Pons and Katia Porzecanski. “Venezuela Lets Bolivar Depreciate 88% on New Sicad II Market.” Bloomberg. 25 March 2014. http://www.bloomberg.com/news/2014-03-24/venezuela-to-start-trading-dollars-for-first-time-in-four-years.html

Pons, Corina. “Venezuela Reaches Deals With Six Airlines to Pay Dollar Debt.” Bloomberg. 26 May 2014. http://www.bloomberg.com/news/2014-05-26/venezuela-reaches-deals-with-six-airlines-to-repay-dollar-debt.html

Rodriguez, Francisco. “Venezuela in Focus: the Adjustment View.” Bank of America strategy paper. 7 May 2014. https://docs.google.com/a/coha.org/file/d/0BwJa4qkRMTYSQVY0cEg5RUg4S00/edit

[18] Pons, Corina. “Venezuela Reaches Deals With Six Airlines to Pay Dollar Debt.” Bloomberg. 26 May 2014. http://www.bloomberg.com/news/2014-05-26/venezuela-reaches-deals-with-six-airlines-to-repay-dollar-debt.html

[19] Ibid.

Rodriguez, Francisco. “Venezuela in Focus: the Adjustment View.” Bank of America strategy paper. 7 May 2014. https://docs.google.com/a/coha.org/file/d/0BwJa4qkRMTYSQVY0cEg5RUg4S00/edit

[20] Bolding in original.

Toro, Francisco. “What adjustment is, and what it isn’t.” Caracas Chronicles. 15 May 2014.http://caracaschronicles.com/2014/05/15/what-adjustment-is-and-what-it-isnt/

[21] Toro, Francisco. “Adjustment or collapse? The case for collapse.” Caracas Chronicles. 20 May 2014. http://caracaschronicles.com/2014/05/20/adjustment-or-collapse-the-case-for-collapse/

[22] Weisbrot, Mark. “SICAD II is Important Step Toward Resolving Exchange Rate Problem in Venezuela.” Center for Economic and Policy Research. 6 April 2014.http://www.cepr.net/index.php/op-eds-&-columns/op-eds-&-columns/sicad-ii-is-important-step-toward-resolving-exchange-rate-problem-in-venezuela

[23] Ibid.

[24] Rodriguez, Francisco. “Venezuela in Focus: the Adjustment View.” Bank of America strategy paper. 7 May 2014. https://docs.google.com/a/coha.org/file/d/0BwJa4qkRMTYSQVY0cEg5RUg4S00/edit

[25] Ibid.

[26] Dutka, Z.C. “Polls Reveal Wider Concerns of Venezuelan Public” Venezuelanalysis. 12 May 2014. http://venezuelanalysis.com/news/10679

[27] Weisbrot, Mark. “Venezuela’s Struggle, Widely Misrepresented, Remains a Classic Conflict Between Right and Left.” Center for Economic and Policy Research. 4 March 2014. http://www.cepr.net/index.php/op-eds-&-columns/op-eds-&-columns/venezuelas-struggle-widely-misrepresented-remains-a-classic-conflict-between-right-and-left

Weisbrot, Mark. “The Story of Venezuela’s Protests May Be Different From What You Are Told.” Center for Economic and Policy Research. 13 April 2014.http://www.cepr.net/index.php/op-eds-&-columns/op-eds-&-columns/the-story-of-venezuelas-protests-may-be-different-from-what-you-are-tol

Corrales, Javier. “Venezuela’s Middle Ground.” Foreign Policy. 22 April 2014. http://www.foreignpolicy.com/articles/2014/04/22/venezuelas_middle_ground

Zibechi, Raúl. “Venezuela: Petro-‘Socialism’ in its Labyrinth.” Center for International Policy Americas Program. 20 April 2014. http://www.cipamericas.org/archives/11889

[28] Eisen, Arlene. “Venezuelan Capital Sees Rise in Violent Street Bands Following Opposition Withdrawal from Peace Talks.” Venezuelanalysis. 14 May 2014. http://venezuelanalysis.com/news/10683

Weisbrot, Mark. “The truth about Venezuela: a revolt of the well-off, not a ‘terror campaign’.” The Guardian. 20 March 2014. http://www.theguardian.com/commentisfree/2014/mar/20/venezuela-revolt-truth-not-terror-campaign

Cannon, Barry. “Opposition in Bolivarian Venezuela: Caught Between Conflict and Compromise.” Venezuelanalysis. 2 May 2014. http://venezuelanalysis.com/analysis/10658

[29] Smilde, David and Hugo Pérez Hernáiz. “Opposition Freezes Dialogue.” Washington Office on Latin America: Venezuela Blog. 14 May 2014. http://venezuelablog.tumblr.com/post/85758319189/opposition-freezes-dialogue

[30] “US House of Representatives approves Venezuela sanctions.” BBC. 28 May 2014. http://www.bbc.com/news/world-latin-america-27615148

[31] See Menendez for the sponsors’ goals. Conyer, Smilde, and León argue that sanctions will allow Maduro to refocus the issue to US interventionism, thereby diverting political pressure by changing the discourse.

Menendez, Robert. “The Venezuelan nightmare.” CNN Opinion. 20 May 2014. http://www.cnn.com/2014/05/20/opinion/menendez-venezuela/index.html

Conyer, John and COHA staff. “Congressional Letter to President Obama: Stop Sanctions on Venezuela.” Council on Hemispheric Affairs. 30 May 2014. https://coha.org/congressional-letter-to-president-obama-stop-sanctions-on-venezuela/

Smilde, David. “Sanctions on Venezuela would be counterproductive.” Washington Post. 19 May 2014.http://www.washingtonpost.com/opinions/david-smilde-sanctions-on-venezuela-would-be-counterproductive/2014/05/19/fb7516da-decf-11e3-8dcc-d6b7fede081a_story.html

León, Luis Vicente. “¿Sanciones efectivas?” El Universal. 1 June 2014.http://www.eluniversal.com/opinion/140601/sanciones-efectivas