Two Roads to Recovery

When Argentina abandoned its currency board in 2002 amidst massive foreign debts and rampant currency overvaluation, the resulting economic devastation spread from Buenos Aires across the Río de la Plata basin to Montevideo. A global economic downturn in 2001, combined with a massive run on banks by both Uruguayan and Argentine depositors, left both financial sectors in virtual ruin and forced a break from the central banks’ targeted monetary and exchange rate policies. However, since the 2002 crisis, Uruguay and Argentina have dually experienced near-miraculous recoveries, although they achieved economic expansion through notably different mechanisms. Argentina obtained twin trade and fiscal surpluses by increasing tax revenue and riding an international commodity price-boom, while Uruguay, with a highly educated populace and stable financial institutions, has become an offshore haven. The Uruguayan government successfully restructured its external debt and utilized its comparative advantages in agriculture as well as tourism to achieve rapid GDP growth averaging 8 percent from 2004 to 2008. With the world economy currently entrenched in a global financial crisis, the United States and Europe can learn from Uruguay and Argentina, whose post-2002 economic recoveries provide insightful and differing case studies for alternative methods of recession-recovery policy.

Recovery in Argentina

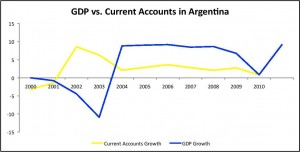

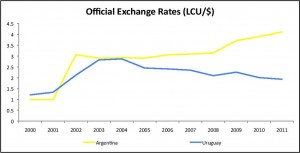

In the aftermath of an economic disaster that resulted in the largest default on sovereign debt in modern history, Argentina used a combination of real exchange rate (RER) and inflation targeting to help induce economic growth, defying austerity and bailout-based orthodoxy. Between 2002 and 2008, inflation never reached an official level above 10 percent, and the exchange rate with the U.S. dollar depreciated only slightly from 2.9 to 3.1.(1) Argentina used this monetary stability to help gain twin surpluses, in current accounts and fiscal budget, which in turn allowed the Argentine government to responsibly resolve much of their sovereign debt. With these surpluses, GDP rocketed from an 11 percent contraction in 2002 to over 8 percent growth annually during the 2003 to 2008 period. Per capita income rose following the same trend. While countries such as the United States and Spain have retained high unemployment figures during their early recovery efforts, such prosperity allowed Argentine unemployment levels to drop from 20 percent in 2001 to a 20-year low of 7.8 percent in 2008. These economic figures certainly demonstrate that Argentina made a miraculous recovery from the default; however, such an unorthodox approach also has led to wide skepticism over whether this growth was sustainable.

Notably, Argentina funded much of its recovery through the exportation of commodities and provision of government subsidies to domestic firms, an approach aligned with the nation’s populist-protectionist economic system. Based on a world commodity price index, between January 2002 and January 2008, commodity prices rose by over 223 percent, or roughly 40 percent annually in the global marketplace.(2) Paralleling this commodity boom, exports rose to compose 25 percent of Argentine GDP by 2003, while final consumption expenditures fell to only 70 percent of GDP, demonstrating the increased importance of exports to the Argentine economy. These exports took advantage of the depreciated currency while massive government surpluses fed subsidies, making Argentine exports even more competitive in international trade. Thus, maintaining the competitive RER was of paramount importance for the Argentine Central Bank, a process that they upheld through inflationary targeting and the regulation of both the domestic and foreign monetary flows.

Unlike the recovery plans of many of its struggling counterparts, which used fiscal austerity and monetary conservatism to reduce government deficit while bailing out the financial sector using loans from various international financial institutions, the unconventional protectionist strategy Argentina adopted barely relied on this internationalized, contraction-based framework, and rather focused on growth through government intervention. While this strategy enabled Argentina to achieve flexibility other economies-in-recovery often lack, it also subjected Argentina to global criticism. However, the Argentine case study provides considerable insight into an alternative method for post-financial-crisis recovery, one that President Cristina Fernández de Kirchner superciliously named “The Model” for snubbing IMF orthodoxy and taking an activist approach rather than allowing for free-market forces to change the status quo. Moreover, as opposed to Western policies that generally place power in the financial institutions, Uruguay and Argentina were able to control the banking sector, implementing transparency measures in an attempt to regain the trust of their respective citizenries. Although defaulting on public debt should not be seen as a valid bailout measure to jumpstart an economy, for Argentina the default crisis ultimately ended with macroeconomic stability that helped Buenos Aires expand both employment and economic growth.

Recovery in Uruguay

Just as Uruguay fell victim to the banking contagion spreading across the Río de la Plata from Buenos Aires, Montevideo inherited some of the successes and failures resulting from the Argentine recovery. However, Uruguay also attempted to break away from the MERCOSUR-backed Argentine-Brazilian economic hegemony forming in the region on its path to recovery. Through a mixture of highly liberal policies and improvements of social institutions, as well as a dearth of indigenous conflict and a historical tendency toward peace, Montevideo engineered one of the most successful recoveries from a financial crisis in the past 20 years. As opposed to criticisms over the Argentine recovery, Uruguay did not rely on simply RER targeting and protectionist trade policies, instead gaining investment from international entrepreneurs due to inexpensive land prices as well as growth prospects in such commodity markets as meat, rice, soybeans, software, ports, tourism, and the export of business services.

To help maintain monetary control with the onset of the new floating exchange rate regime, Uruguay implemented an inflation targeting policy in 2002, mirroring the Argentine program. Yet, Uruguay could not use the interest rate as the primary instrument to regain control over its economy, due to lack of widespread credit availability; therefore, the Central Bank turned instead to the monetary base. Through a sophisticated information system, including an estimation of the money demand, projection-enabling features, and a strategy to collaborate with the private sector, the Central Bank stopped runaway inflation and implemented transparency measures.(3) Because this policy focused solely on understanding the money supply while ignoring other monetary-policy tools, the interest rate remained in near triple digits throughout 2002. Nevertheless, by the end of 2003, rising exports, low inflation, and a successful debt exchange program boosted the Uruguayan economy out of the recession.

Montevideo’s ultimate goal during the recovery was stability. To achieve this end, the Central Bank implemented various transparency measures on buying foreign currency and expanding the monetary base. The purpose of these policies was to clarify the Central Bank’s objective in regards to the exchange market, using only foreign reserves to prevent a run on banks, and open communication lines between the public, government, and private sectors. Ultimately, inflation remained below Uruguay’s target, due to a dearth in credit expansion, a deep drop in aggregate supply, and an increase in money demand brought on by the swiftly recovering economy. This relatively low inflation helped stabilize the money supply, influence a decrease in the interest rate, and elongate bond maturity. As the volatility of the Uruguayan economy decreased and expectation of a further depreciation in peso-to-dollar exchange rate set in, the populace became more confident in these new monetary policy instruments; therefore, Montevideo achieved its primary goal.

However, the resounding issue for Uruguay, along with most of Latin America, remained dollarization, a trend that stretches back some 30 years and reveals larger societal cracks than simply economic troubles, namely a distrust of the government to control financial institutions and the wider economy. Western countries have seen this trend emerge in recent years, though how the economy manifests the consequences of the distrust remains to be seen. In Uruguay, to combat such a reality, Montevideo undertook an institutional approach to economic policy, playing off its traditionally strong social institutions and norms. The radical policy decisions regarding the educational system as well as industrial policy targeting both the agriculture and tourism sectors helped Uruguay break from both “The Model” and IMF orthodoxy, creating yet another option for recession recovery.

Institutions and the Economy

Uruguay’s educational system has long been one of the most respected institutions in South America. With net enrollment rates approaching 100 percent as well as free and compulsory education from pre-primary up to the secondary level, Uruguayans hold the highest literacy rate in Latin America, nearly 100 percent in both the youth and adult populations. Recently, the government implemented Plan Ceibal, which aimed to provide a laptop and free Internet access for every primary school student. Costing only 5 percent of the total educational budget, Plan Ceibal aimed to close the technological gap while improving the overall educational system.(4) Although these laptops, the so-called “ceibalitas,” have drawn praise from students as well as interest across the world from academics and policymakers alike, as the Economist points out, problems underlying the system, such as connectivity and broken machines, persist.(5) Nevertheless, innovative educational policies have enabled the Uruguayan populace to become one of the most educated in the Western Hemisphere, opening doors for the economic benefits of globalization.

Investment in education paid off handsomely for Uruguay after the 2002 financial crisis. Tata Consultancy Services, one of India’s biggest technology and offshoring companies, began running operations out of Montevideo shortly after the recession ended, using 650 Uruguayan engineers to help run the computers and backrooms for American Express, Proctor and Gamble, and major U.S. banks.(6) At this time, many American investors wanted to diversify their portfolios to reduce the risk of shutdowns in India, and Montevideo provided the perfect outlet for this function. As New York Times columnist Thomas Friedman pointed out, “Uruguay’s quality education system had produced plenty of good, low-cost engineers;” therefore, “Tata could offer its clients the best Indian engineers during India’s day and its best Uruguayan engineers during America’s day.”(7) Uruguay has quickly become the largest offshoring center in Latin America, an important contribution to Uruguay’s recovery from the 2002 crisis and evidently an outcome of Montevideo’s continued institutional support for high-quality education.

In combination with this institutionalized approach, vertical policies, such as promoting agricultural growth and pushing an ambitious tourism development strategy, acted as a quasi-industrial policy. Detailed regulations to eradicate foot and mouth disease, an ailment that aggravated the 2002 crisis by greatly harming the farming sector, have allowed beef exports to gain access to the U.S. market.(8) Moreover, targeted development of the soybean industry—cheap land, minimal export barriers, and the growth of soybean usage worldwide for animal utilization—has pushed the soybean to the status of the single largest Uruguayan export.(9) Due to foreign investment in oilseed farming, soybean harvest area alone rose from 77,000 hectares in 2002 to 240,000 in 2005; Uruguay now exports almost its entire soybean harvest.(10) Moreover, the government implemented a business strategy to aggressively expand tourism beyond the traditional mainstays of Punta del Este and Montevideo through improved infrastructure, the preservation of historical and cultural sites, and incentives for private hotels.(11) By 2009, Uruguay received 62 tourists per 100 people living in Uruguay, the highest per capita rate in Latin America, and its returns from tourism totaled 25 percent of GDP.(12) Ultimately, this targeted industrial policy, born from successes in East Asia during the emergence of such strong economies as Japan and South Korea in the 1970s, has benefited Uruguay’s economy, boosting the nation’s competitive industries that benefit from comparative advantages.

Conclusion

After the Argentine and Uruguayan economies collapsed during the 2002 financial crisis, each experienced a dramatic, albeit different recovery. Argentina used an unorthodox monetary policy that centered on real exchange rate targeting and protectionism, while Uruguay sought stability in its inflation rate and utilized its exemplary social and economic institutions to gain comparative advantages in areas such as education, agriculture, and tourism. Although the Brazilian economy also played an important role in the regional economic framework, particularly through Mercosur, Uruguay was connected primarily to the Argentine economy due to Argentines depositing savings in Uruguayan banks. Thus, Uruguay experienced both the positive and negative aspects of the Argentine recovery efforts while attempting to distinguish its own recovery plan. Instead of focusing on fiscal austerity, which in turn leads to stagnant unemployment and the financial sector gaining further control over governmental economic functions, Argentina and Uruguay placed an onus on the role of the state in interventionist policies that strove for transparency, employment, and social development. With financial crises spreading from the global south to the global north, lessons from Uruguay and Argentina appear paramount in formulating an alternative method for recession-recovery economics.

To view citations, click here.

Please accept this article as a free contribution from COHA, but if re-posting, please afford authorial and institutional attribution.

Exclusive rights can be negotiated.