U.S Sugar Subsidies and the Caribbean’s Sugar Economies

Agricultural policy is a highly controversial topic in the United States, for while Washington pushes economic openness for other nations, it actively employs protectionist policies when it comes to its own closely held economy. This is especially true with sugar. The U.S. government heavily subsidizes its sugar sector, imposes quotas on sugar imports, and then hectors developing countries on the wisdom of cutting back on their own subsidies. These measures protect private U.S. sugar producers from foreign competition, allowing them to seek unreasonably high prices in the U.S. market. U.S. consumers are likely to lose from these policies, as they end up paying higher prices at U.S. supermarkets, and, moreover, Caribbean sugar prices also have been adversely affected by U.S. protectionism in the sugar industry.

The Caribbean Sugar Economies

The implementation of sugar quotas by the United States has led to colossal losses for Latin American sugar economies. Sugar quotas have often been used for political objectives against Caribbean countries. Since 1985, millions of U.S. dollars have been spent—and wasted—in an attempt to revive the sugar industry by poor Caribbean-basin countries. Narrowly implemented U.S. trade policies have pushed Caribbean sugar economies to the verge of collapse. The United States annulled the Cuban sugar quota in 1961, just two years after the Cuban Revolution. Likewise, Nicaragua’s “quota was reduced to zero” when the Sandinista National Liberation Front overthrew the U.S.-backed Somoza regime. [1] The United States now has an absolute trade embargo with Cuba after U.S.-owned sugar companies in Cuba were nationalized in 1961. Before the revolution, 69.1 percent of Cuban trade overall and 54.8 percent of its sugar trade was with the United States. [2] The revolutionary government nationalized the sugar industry, a move that was seen as against free market principles. Yet Washington violates similar principles by keeping its sugar policy narrowly in place. Such double standards that block sugar imports from struggling Caribbean markets will continue to impair and distort U.S.-Caribbean relations.

Although the U.S. government blamed Fidel Castro for unfairly nationalizing the country’s sugar factories owned by Florida’s Fanjul family, most Cubans saw the family’s control over its major commodity as a form of colonial-style domination. Fanjul was likened to the East India Company on the Indian subcontinent during the British Raj. Under Fanjul’s domination of the Cuban sugar industry, the majority of sugar produced went to United States, leaving a shortage for domestic consumers who ended up paying higher prices. Nationalist sentiments, mixed with a desire to free the economy from U.S. interference, led to nationalization of American companies. The Fanjul family still owns sugar factories in Latin America, especially in Mexico and the Dominican Republic, although its major sugar plants are now in Florida. American environmentalists have voiced serious concerns about the Fanjul family’s sugar production in Florida, as it enormously damages the Everglades and the Florida Bay, and results in drainage and biochemical discharge that harms native animal habitats. [3]

Remnants of the previous neo-colonial relations, that at one time defined U.S.-Caribbean interaction as a hierarchical relationship of dominator and dominated, can nowadays be found in the United States’ sugar policy, which has prevented equitable trade arrangements with poor Caribbean countries. The sugar industries in Guyana, Jamaica, Barbados, Trinidad, and Belize now face difficulty in exporting sugar due to protectionist U.S. sugar policies. In most Caribbean islands, the Agriculture Production Index, a measure of aggregate agricultural production in a given time period, has been declining in the past few decades because of U.S. farm subsidies. For instance, in Jamaica the index declined by 16.6 percent from 1996 to 1997. [4]

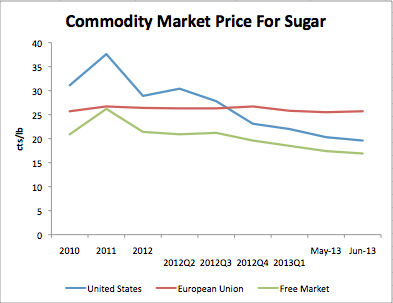

While it cannot be denied that factors such as poor governance, diseconomies of scale, lack of technical know-how, political instability, and a low world price for sugar affect Caribbean sugar production, U.S sugar policy has had the strongest negative effect on Caribbean sugar economies. In fact, the reason that the world price of sugar is at a historical low right now is because the United States and the European Union have driven down the global price for sugar by imposing trade restrictions on foreign imports. In 2002, “Cuba shut down half its once-mighty sugar industry,” and shortly thereafter in 2003, Trinidad’s state owned sugar company decided to make “all of its 9,200 employees redundant.” [5]

Some advocates of the United States’ sugar policy argue that in a globalized world, Caribbean countries can target other larger markets. But European sugar policies are hardly any different from those of the United States. Indeed, Europe’s agricultural sector is one of its most subsidized sectors. Tereos, the French sugar conglomerate, hauled off one of the biggest E.U. subsidies, taking a total of $223 million USD last year alone. [6] Studies also show that countries geographically closer to each other trade the most. It would not be very profitable for struggling Caribbean economies to export a non-durable commodity like sugar to the other side of the globe, on account of high shipping costs. It is more likely that African countries would export sugar to E.U. countries, as they are closer to Europe. Here, it makes more sense for Caribbean economies to export to the United States.

Ever since the Great Depression of the early 1930s, Congress has prioritized its Farm Bills over other important decisions and policies. The whole notion behind the Farm Bill was to create a dynamic domestic food supply and make the United States less dependent on other nations for food. Due to an excess of global food supply in the 1930s and the stock price decline during the Great Depression, U.S. farmers suffered a huge blow from falling prices for agricultural commodities. President Roosevelt came to the ‘rescue’ of farmers by implementing the Farm Bill to support domestic farm prices during the Great Depression. Since then, sugar lobbies have misused the Farm Bill. It comes with a huge opportunity cost to the United States, as farm policy benefits only a few. The CATO Institute’s trade policy analysis estimates that the total cost of U.S. farm support programs was $1.7 trillion USD over the past 20 years. [7]

Arrangement of the Subsidy Program

The pending U.S. Farm Bill once again favors the sugar lobby by providing it with subsidies and monopolistic access to the domestic market, which could have serious ramifications for U.S. sugar policy in the coming years. Although the Farm Bill failed to initially pass in the House this year by a vote of 234 to 195, private sugar lobbies have not given up, and are pressing to ensure that it passes in this session. Every year the U.S. government gives out $25 billion USD to agribusinesses, with 75 percent of all subsidies going just to 10 percent of the country’s farms. [8] As a consequence of U.S. policy, sugar prices in the United States have now soared to three times the world price and currently stand at about 20 cents per pound, compared to less than 10 cents just a decade ago. American consumers and shopkeepers bear the burden of the deadweight loss brought about by sugar subsidies and import restrictions. Inflated sugar prices cost consumers $3.5 billion USD annually, in addition to the tax payments that fund the generous payouts to agribusiness. [9] Sugar subsidies and protectionist policies demonstrate quintessential special interest lobbying, and result in a generous but largely undeserved gift to well-connected economic interests. Anti-protectionists insist that the U.S. domestic sugar market should be opened up to unrestricted trade.

Subsidies to sugar producers are transmitted from the U.S. government to farmers through a “complex system of loans and quotas.” [10] Loans are usually granted directly to processors instead of farmers, so there is hardly any wealth transfer from top to bottom. Production workers and laborers earn minimum wage. Provided the harvest yields revenues higher than the cost of the loan, the loans are repaid to the government and profits are retained. However, if profits are meager, the company can pocket the advance from the government and leave the bureaucrats to either sell the sugar at a loss or pay to store it and hope for a price rise later. This price control mechanism allows the government to prevent sugar prices from falling.

Last year, sugar prices in the United States only fell from 25.5 cents per pound to 21 cents per pound due to poor harvests, but private companies were able to repay their loans in the form of sugar instead of cash. [11] This quarter, the United States Department of Agriculture (USDA) plans to buy sugar from producers at an approximate cost of $38 million USD in order to increase sugar prices, which will maximize benefits for the producers. [12] The USDA plans to sell the sugar to ethanol-producing firms for a much lower price than it initially loaned it out at. [13] This practice results in huge losses for the government. According to this fiscal year’s forecast, the government plans to buy 400,000 tons of sugar—leading to a federal loss of $80 million USD when sold to ethanol producers. [14] In the past nine years, sugar processors have borrowed $8.8 billion USD from the government at very low interest rates ranging from 1.125 percent to 1.25 percent in 2012. [15] (By way of comparison, student loans are usually at about 7 percent interest, a situation so unfair it scarcely requires comment.) Additionally, the USDA does not care how the processors spend the borrowed money, which means that this loan mechanism is unregulated. [16] This means that the borrowers can even spend the amount for their personal use if they chose, and thus taxpayers’ money routinely winds up in the hands of sugar-producing families. The nation continues to incur losses from sugar companies’ success in lobbying for the maximization of their personal welfare.

According to the Wall Street Journal, sugar companies were amongst the largest donors to politicians in the 2012 election cycle. [17] Politicians and congresspeople, in return, vote in favor of federal farm subsidies. That is precisely the reason why the Farm Bill is expected to pass, as it has had no problems in getting House approval in the past. According to the USDA, $644 million USD still remain unpaid by sugar producers for the current fiscal year, and payments are due August 1. [18] Economists speculate that these companies are most likely to default, inflicting more damage on U.S. taxpayers. With a national debt of about $16 trillion USD, it makes little economic or social sense to spend billions of dollars on such a policy, which comes at an enormous cost to society. Furthermore, according to a report by the conservative CATO Institute, the Farm Bill is also subject to fraud and corruption. $1.3 billion USD in subsidies have been directly transferred to farm owners who did not use their farms for produce; $500 million USD, annually, is improperly recorded as contributing to production. [19]

Another aspect of U.S. sugar policy is the quota system. Quantities of imports above the quota limit are subject to stiff duties. Sugar imports that exceed set quotas are struck with “a prohibitively high duty of 16 cents per pound,” which is “sufficiently high to make sugar imports unprofitable.” [20] In 1998, the Dominican Republic, the Philippines, and Australia had some of the least restrictive quotas, allowing more of their sugar to enter the United States, whereas Peru, Panama, El Salvador, Colombia, Mexico (despite the North American Free Trade Agreement), Costa Rica, and other Caribbean countries had the most restrictive penalties in place, keeping their sugar out of the U.S. market. [21] These statistics vary across time, but sugar prices in the United States have remained above the free market price. Today, Brazil, one of the largest producers of sugar, is subject to a similar quota, along with 40 other countries. [22] Many of these are impoverished Caribbean countries that have been producing sugar for centuries. Tropical and naturally fertile Caribbean islands with perfect weather conditions are innately suitable for sugar harvest. Cuba, Belize, Barbados, Guyana, Jamaica, St. Kitts & Nevis, and Trinidad & Tobago are amongst the major sugar producers in the region. Excluding Cuba, these islands form the Sugar Association of the Caribbean (SAC). [23]

Conclusion

The Farm Bill is clearly a measure that rewards the sugar lobby and harms the poorest of the hemisphere. Daniel Griswold of the CATO Institute correctly noted that “the highest trade barriers remaining in the United States are aimed at products that are disproportionately consumed by poor people at home and produced by poor people abroad.” [24] The poor people of the hemisphere are most affected by such an irrational farm policy.

In relative terms, producing an ounce of sugar in the United States is much more expensive than producing the same ounce in the Caribbean. To understand the scale of opportunity cost of sugar subsidies, a 2006 report by the Commerce Department revealed that each preserved job in the U.S. sugar industry represents three jobs lost in confectionery manufacturing due to the resulting hike in sugar costs. [25] 20,000 jobs in the confectionary industry are lost every year due to the sugar policy of the United States. [26] In a world where global economies are indelibly interconnected, protectionist policies by the United States can have serious ramifications for countries in Latin America and the Caribbean.

In 1984, New Zealand’s government eliminated all of its agriculture subsidies and repealed its protectionist policies. This allowed for foreign competition, innovation, and adoption of better technology in its farming sector. Today, New Zealand is one of the largest exporters of quality agricultural products around the globe. The United States should look to the example it provides. U.S. consumers would be better off buying lower cost sugar from Caribbean basin countries, and Caribbean farmers living in poverty need fair access to the U.S. market. The United States portrays itself as the biggest supporter of free market economies, yet it violates the very basic idea of the free market system through its sugar policy.

Bilal Maneka, Research Associate at the Council on Hemispheric Affairs

Please accept this article as a free contribution from COHA, but if re-posting, please afford authorial and institutional attribution. Exclusive rights can be negotiated.

For additional news and analysis on Latin America, please go to: LatinNews.com and Rights Action

References

[1] Professor Najjar, Nabil Al and Baliga, Sandeep. “Sugar Daddy: Quotas and the U.S. Government,” Kellog School of Management, Northwestern University. HBS Case Study, 2004. Accessed July 17, 2013.

[2] William M. Leo Grande, ‘Cuban Dependency: A comparison of pre-revolutionary and post revolutionary International Economic Relation, 1979, pp, 1-29

[3] Schwabach, Aaron. “How Free Trade Can Save The Everglades,” The Goergetown International Environmental Law Review, Accessed July 15, 2013.

[4] Dr. Ahmed, Bilal. “The Impact of Globalization on Caribbean Sugar And Banana Industries,” The society for Caribbean studies annual conference papers, University of Nottingham 2-4 July 2001. Accessed July 23 2013

[5] “The Caribbean Sugar Industry, Sweet And Sour,” The Economist. August 28 2003. Accessed July 13, 2013, http://www.economist.com/node/2024522

[6] Walt Vivienne. “Even In Hard Times, E.U. Farm Subsidies Roll On,” Time. May 14 2010. Accessed July 17, 2013. http://www.time.com/time/business/article/0,8599,1989196,00.html.

[7] Griswold Daniel. “Making the Case For Free Trade,” CATO Institute. October 30, 2004. Accessed July 17, 2013.

http://www.cato.org/publications/speeches/making-case-free-trade

[8] “That Sickening Sugar Subsidy.” Bloomberg.com. Bloomberg, 13 Mar. 2013. Web. 26 July, 2013. http://www.bloomberg.com/news/2013-03-13/that-sickening-sugar-subsidy.html

[9] Beghin, John and Elobeid, Amani “The Impact of U.S. Sugar Program,”sugarreform.org. November 17 2011. Accessed date 20 July 2013. http://sugarreform.org/wp-content/uploads/2011/11/The-Impact-of-the-U.S.-Sugar-Program-Beghin-Elobeid-Report-11.17.11.pdf.

[10] “Sugar’s Sweet Deal.” Forbes. Forbes Magazine, n.d. Web. 26 July 2013. Joshua Zumbrun. 6/30/2008. http://www.forbes.com/2008/06/27/florida-sugar-crist-biz-beltway-cx_jz_0630sugar.html. Accessed Date: July 20 2013

[11] “That Sickening Sugar Subsidy.” Bloomberg.com. Bloomberg, 13 Mar. 2013. Web. 26 July, 2013. http://www.bloomberg.com/news/2013-03-13/that-sickening-sugar-subsidy.html

[12] “3 Firms Got Most Sugar Aid.” Wall Street Journal (n.d.): n. pag. Sage. Web. <http://search.proquest.com.resources.library.brandeis.edu/wallstreetjournal/docview/1371707651/13F2A898FB716DFDA24/2?accountid=9703>.

[13] “That Sickening Sugar Subsidy,” Bloomberg.com, Bloomberg, 13 March 2013, Accessed 26 July, 2013, http://www.bloomberg.com/news/2013-03-13/that-sickening-sugar-subsidy.html

[14] “3 Firms Got Most Sugar Aid.” Wall Street Journal (n.d.): n. pag. Sage. Web. <http://search.proquest.com.resources.library.brandeis.edu/wallstreetjournal/docview/1371707651/13F2A898FB716DFDA24/2?accountid=9703>.

[15] Alexandra Wexler, “Bulk Of U.S. Sugar Loans Went To Three Companies,” Wall Street Journal , June 26 2013, Accessed July 23, 2013. http://online.wsj.com/article/SB10001424127887323689204578569332949046260.html

[16] Fox, Lauren. “Tempers Run High in Congress Over Student Loan Debate.” US News. U.S.News & World Report. 09 July 2013. Accessed July 23, 2013.

[17] “3 Firms Got Most Sugar Aid.” Wall Street Journal (n.d.): n. pag. Sage. Web. <http://search.proquest.com.resources.library.brandeis.edu/wallstreetjournal/docview/1371707651/13F2A898FB716DFDA24/2?accountid=9703>.

[18] Alexandra Wexler, “Bulk Of U.S. Sugar Loans Went To Three Companies,” Wall Street Journal , June 26 2013, Accessed July 23, 2013. http://online.wsj.com/article/SB10001424127887323689204578569332949046260.html

[19] Chris Edwards, “Ten Reasons To Cut Farm Subsidies,” CATO Institute. June 28, 2007. Accessed: July 21 2013. http://www.cato.org/publications/commentary/ten-reasons-cut-farm-subsidies.

[20] Professor Najjar, Nabil Al and Baliga, Sandeep. “Sugar Daddy:Quotas and the U.S. Government,” Kellog School of Management, Northwestern University. HBS Case Study, 2004. Accessed July 17, 2013.

[21] Ibid.

[22] “Sugar’s Sweet Deal.” Forbes. Forbes Magazine, n.d. Web. 26 July 2013. Joshua Zumbrun. 6/30/2008. http://www.forbes.com/2008/06/27/florida-sugar-crist-biz-beltway-cx_jz_0630sugar.html. Accessed Date: July 20 2013

[23] Armstrong, Delroy Anthony. “The Potential Impact of Trade Policy Changes on Caribbean Sugar,” Louisiana State University. August 2004. Accessed July 19, 2013 http://etd.lsu.edu/docs/available/etd-1121103-010631/unrestricted/ Armstrong_thesis.pdf.

[24] Griswold Daniel. “Making the Case For Free Trade,” CATO Institute. October 30, 2004. Accessed July 17, 2013.

http://www.cato.org/publications/speeches/making-case-free-trade

[25] Sens: Shaheen, Lugar, Toomey, “Sugar subsidies out of date,” The Hill Op-Ed. August 8 2012. Accessed July 19, 2013. http://www.shaheen.senate.gov/news/in_the_news/article/?id=4207ed0f-5056-a032-52bf-e9c405ebb514,

[26] Website Homepage, http://www.candyusa.com/, Accessed July 21, 2013.