Paraguay and the Pacific Alliance: Why the Country Should Not Join the Regional Bloc

On May 23, 2013, Paraguay was accepted as an observing member of the newly formed Pacific Alliance at a summit of regional leaders in Cali, Colombia. Paraguayan officials have expressed confidence that entrance into the regional bloc will strengthen economic ties to global partners in Asia and Latin America and further stimulate the economy. But Paraguay’s problems, most notably the continued high level of economic inequality, will not be quickly remedied by an increase in exports of soybeans and other goods. In fact, entrance into the Pacific Alliance could well serve to exacerbate economic inequality, possibly even generating a land grab by Brazilian soybean farmers and agribusinesses in Paraguay that could push small holders off their plots. While there are certainly advantages to joining the Pacific Alliance, doing so cannot, in the end, offer a one-step solution to what ails Paraguay. Incoming president Horacio Cartes would be well advised to instead focus on pushing through land reform for small holders and amending Paraguay’s regressive taxation system rather than entering into trade arrangements that are mainly designed to profit the already prosperous landholders.

The Appeal of the Pacific Alliance

Applauded by Colombian President Juan Manuel Santos as a “new engine for economic growth and development,” [1] and even projected to be “the most important integration project in the history of Latin America,” [2] the Pacific Alliance advertises enduring economic success for member countries. The bloc hopes to integrate its Latin American members—currently Mexico, Chile, Colombia, Costa Rica, and Peru—with the burgeoning Asia Pacific economies, thereby stimulating growth in Latin America. At the summit, Santos declared that, “The Asian Pacific is the new pole for development and Latin America wants to be a partner in that development.” [3]

At the May 23 summit, leaders of the Pacific Alliance countries announced the removal of tariffs on 90 percent of all goods that pass between member countries and the elimination of all remaining tariffs imposed on member countries in the next few years. [4] This will produce an extensive free trade zone amongst the economies in the area covered by the Alliance. Members of the Pacific Alliance have already integrated their stock exchanges, taken initiative in energy coordination, and conducted trade agreements with the United States and Europe. [5] Pacific Alliance members further announced at the summit that the trade bloc would create a general visa for tourists to use in all member countries and drop visa requirements for businesspeople and students in order to support investment and education. [6][7] They also created the Common Cooperation Fund, in which member countries allocate a portion of their revenues toward poverty alleviation and other development projects. These efforts suggest that the Pacific Alliance has ambitions to transcend the strictly economic goals of traditional free trade agreements. [8][9]

Paraguay has several reasons to solicit a place in the Pacific Alliance, a bloc whose members claim an annual average growth rate of 5 percent. [10] Colombian Minister of Trade, Industry, and Tourism Sergio Diaz-Granados declared on June 6, 2012, that:

The Alliance can become a platform of economic and trade integration, as well as a bridge to the rest of the world, particularly with the Asia-Pacific. This initiative will promote higher growth, development, and competitiveness of the economies of the Member countries, as well as expand their economic relations with the Asia-Pacific. Undoubtedly, this new bloc will mean a breakthrough in the economic integration of Latin America, and it will be the opportunity to realize the commercial potential of the Member economies. [11]

Diaz-Granados forecasted that economic integration in the free trade zone would strengthen the economies in the Pacific Alliance by opening foreign markets to domestic producers. In the same vein, Paraguayan officials hope that a larger export market for soybeans, the nation’s leading export, will bring rapid economic growth.

Paraguay’s Export-Led Growth

Paraguay’s growth has long been rooted in the soybean industry, which developed after a rise in Brazilian land prices in the 1970s led soybean farmers to look to neighboring countries, including Paraguay, for relatively cheap land. [12] These farmers bought vast plots of land and imported capital from Brazil to mechanize the sowing and harvesting of soybeans. This was primarily done under the direction of a few Brazilian landowners tied to agribusiness interests. [13] Today, not only Brazilian companies but also U.S. and other foreign companies, such as Cargill, ADM, and Bunge, dominate soybean production and exportation in Paraguay. [14]

With favorable weather since 2009 and growing foreign markets for soybeans, Paraguayan producers have been able to export unprecedented amounts of soybeans. Oxfam International’s executive director, Jeremy Hobbs, noted in July 2012 that “demand [for soy] is surging, driven primarily by China and Europe for cattle feed and biofuels […] More than half of the soy grown in Paraguay is exported to Argentina, and much of this is turned into diesel either in Argentina or in Europe to fuel Europe’s cars.” [15] Even Brazilian companies contribute to this foreign demand: 111,300 tons of Paraguayan soybeans were imported into Brazil between January and July 2010, a 263 percent increase from the same period in 2009. [16] The strong growth of this industry has largely supported Paraguay’s recent GDP surge.

Currently rising at a 13 percent annual rate, Paraguay’s GDP growth is the highest in the Americas this year. [17] In the report, “Socio-Environmental Impacts of Soybean in Paraguay – 2010,” the Non-Governmental Organization, Repórter Brasil, notes that, “Soybean output is the agribusiness star [in Paraguay] and its advocates point out that its weight in the economy should keep increasing in the next years.” [18] In an April 2013 New York Times article, “Boom Times in Paraguay Leave Many Behind,” Simon Romero echoes this conventional view, writing that “Paraguay’s economic boom [… is] fueled by bountiful harvests of export commodities like soybeans.” [19] Because the exportation of soybeans contributes so heavily to growth in Paraguay, policymakers have looked to commodity exports and the Pacific Alliance as a means to improve the country’s economy.

Truncated Linkages

Orthodox economic theory notwithstanding, primary product export predicated on a free trade model cannot bring sustainable growth in small countries. In fact, it can actually exacerbate domestic inequalities. A 2002 United Nations report, “Small Economies in the Face of Globalization,” notes that “free trade, even with special provisions, may be inadequate […] to ensure convergence among economies of different sizes and levels of development.” [20] Even when growth is achieved through free trade, it is not necessarily coupled with reductions in inequality, nor will it help small countries catch up economically with larger ones. This is the case in Paraguay, in which tremendous GDP growth has not alleviated the country’s pronounced inequality or increased its prominence in the region. [21]

Most Paraguayans are not benefitting from the nation’s rapid growth in the foreign-dominated and export-minded agricultural sector, since this sector is not sufficiently tied to the rest of the Paraguayan economy. In fact, a 2011 International Monetary Fund (IMF) country report on Paraguay stated that “although the agricultural sector represents about one fifth of Paraguay’s GDP […] the spillovers from this sector to the rest of the economy are limited [… and] strengthening the linkages of agriculture with the other sectors of the economy is a big challenge.” As Ronn Pineo of the Council on Hemispheric Affairs (COHA) noted in his study on the effects of free markets on the economies of Latin America:

Foreign-controlled firms reinvest less in host nations, share technology less often, train fewer local managers, and stimulate fewer linkages than do domestically controlled firms. Local owners naturally tend to feel a greater attachment and responsibility to their home country than do absentee owners, demonstrating a stronger desire to reinvest profits and to build something tangible that might be passed down to their children and nation. As Henry Bruton has observed, ‘the basic objective is not to attract foreign investment as such, but to create an internal social and economic environment with which the nation knowledge-accumulating process profits from the presence of foreign firms.’ [22]

The domination of the fast-growing agricultural sector by foreign firms is thus problematic for Paraguay. The soybean companies operating in Paraguay import raw materials and use foreign labor and capital to grow soybeans, and then export raw soybeans to other countries. In this way, the foreign firms prevent Paraguayan workers and industries from providing inputs or adding further value to the immense production of soybeans. Further, the companies do not provide much tax revenue to the government, [23] nor, as Fernando Martínez Escobar of the Latin America Bureau has written, “the Paraguayan agroexport model, devoted mainly to exporting raw materials at the lowest possible cost, does not need its population. It has nothing to sell to the people of Paraguay, nor any interest in selling them anything.” [24] The operation of the soybean industry provides little to the people of Paraguay.

Beyond its lack of linkages to other economic sectors that could otherwise promote economy-wide development, growth of the agribusiness sector can even negatively impact Paraguayan society by reinforcing existing power structures. Pineo notes that, “while […] growth is good, raw material export is not a pathway to economic development. Focusing on primary product extraction serves instead to reinforce existing productive structures. Economic growth and economic development are not the same thing.” [25] Critics may believe that selectively increasing the wealth of only those in the soybean industry would not harm those who are not. However, this would shift resources to those in the industry, thereby enabling them to exert more political influence in the country. These empowered individuals will consequently be in an improved position to advocate for their interests and gain more wealth at the expense of others in Paraguay.

Inconsistent Growth in Paraguay

Even though growth has benefitted soybean agribusiness in recent years (at the expense of small farmers and landless peasants), it has been far from consistent on an annual basis. The reliance of Paraguay’s economy on export commodities makes its growth highly subject to shocks in global demand and other external factors. The volatility of the Paraguayan economy is apparent in growth numbers over the past few years. As the aforementioned IMF report on the economy of Paraguay noted:

Paraguay’s economy has recently experienced particularly large output swings, opening again the question of what its potential growth rate is. Notably, in only two years, the economy went from a half-a-century record-low GDP contraction of 3.75 percent in 2009—after the severe and widespread drought of that year and the adverse international environment due to the global [economic] crisis—to a record-high GDP growth of 15 percent in the subsequent year, led by the unprecedented boom in the agricultural sector during 2010. [26]

Paraguay’s growth rate has fluctuated widely in response to external factors and is also continually impacted by other structural factors that are more endogenous to Paraguay. According to Forbes.com, “political uncertainty, corruption, limited progress on structural reform, and deficient infrastructure are the main obstacles to growth” in Paraguay. [27] Policymakers in Paraguay need to address these structural, economic, and political conditions in order to foster sustainable growth.

Still, these reforms would not, on their own, remedy Paraguay’s deep-rooted inequality. To do so, policymakers will need to tackle two persistent obstacles to sustainable growth in the country: unequal land distribution and ineffective tax laws.

Paraguay’s Uneven Land Distribution and Failed Attempts at Land Reform

A major constraint to sustainable growth in Paraguay is the country’s highly unequal land distribution and rural poverty. Rural poverty in Paraguay, as in many other countries in the region, is more prevalent than urban poverty. In January 2010, 24.7 percent of urban residents in Paraguay were living in poverty, compared to a much higher percentage, 48.9 percent, of rural citizens. [28] The government’s failure to alleviate poverty stems largely from its inability to reach a reform in land ownership that would support small farmers and landless peasants, who make up most of those mired in poverty in Paraguay. Land ownership is highly unequal: 2 percent of the population controls more than 75 percent of the fertile land. One third of the rural population is landless. [29] This unequal distribution of land is a colonial vestige of the 35-year Alfredo Stroessner dictatorship, which doled out land to the military and favored foreign interests in order to solidify its political control. [30]

Although the 2008 election of progressive President Fernando Lugo brought the hope of reform, Lugo, as Associated Press correspondent Peter Orsi has noted, “couldn’t implement land reform quickly because the government didn’t have any land under its control to distribute.” [31] Powerful landholders have held off all efforts at reform. On June 15, 2012, government police forces clashed with landless peasants who were protesting the lack of arable land for small farmers. This clash was used by a coalition of opposition parties to legitimize a “parliamentary coup” against Lugo. This conservative coup underscored how difficult it will be for progressive forces to challenge the power of the dominant economic interests in Paraguay.

The mechanization of the soy industry and the intrusion of foreign agribusiness companies into the market for soybean exportation in Paraguay have only served to aggravate inequality within the country—although both have led to increased soybean yields and economic growth. The problem, Repórter Brasil indicates, is that, “the technology for cultivating mechanized soybean does not create jobs” because of the highly mechanized output capacity of the soybean agribusiness industry. [32] Likewise, Romero quotes development economist Andrew Nickson’s statement that, “Nearly all of the growth [in the country] is driven by highly mechanized agriculture, which generates few jobs for the population.” [33] Pineo further argued that:

Care in building a domestic market is essential […] Unlike Latin America, in East Asia land reform typically came before [industrialization], holding down the flood of rural to urban migration, which otherwise could overwhelm the available jobs in industry, driving wages to the subsistence level […] As it was, [industrialization] was put in place in Latin America without land reform, even in the 1960s when ECLAC was calling for this critical step […] This failure in sequencing land reform before government-sponsored industrialization was a key block to economic development. [34]

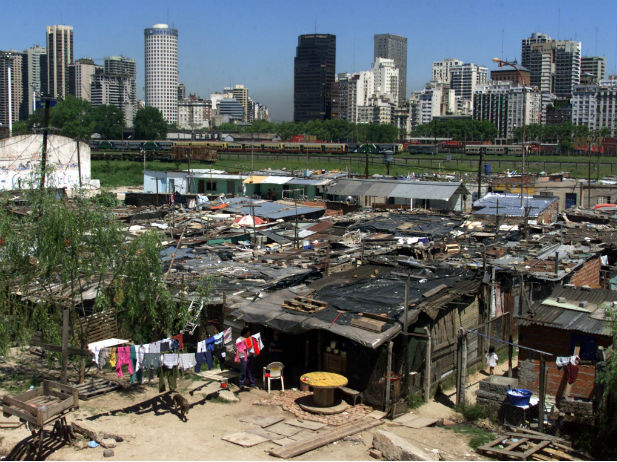

The circumstance of Paraguay fits with this analysis. Without work in the countryside, displaced Paraguayan farmers move to urban areas in search of work. However, few jobs are to be found in the cities, as Paraguay largely lacks urban industrialization and “manufacturing is generally small scale and directed toward processing agricultural products.” [35] These workers often join the informal economy and live in slums that lie beyond the scope of government welfare programs without the ability to significantly contribute to Paraguay’s development.

The prospects of land reform continue to look bleak in light of the current political situation in Paraguay. The election of pro-business candidate Horacio Cartes in April 2013, who has promised to modernize the country by bringing in a wealth of private-sector jobs, suggests that Paraguay is once more realigning itself with markedly conservative interests. Lugo has been sharply critical of Cartes, labeling his “political model [as … ] a return to the past.” [36] Cartes’ ties to agribusiness companies and his focus on the private sector suggest that he will be unwilling to make concessions on land reform or strengthen poverty alleviation programs. Cartes’ Colorado Party was responsible for the parliamentary coup of Lugo and has expressed disdain for land reform movements. As Eric Stadius, writing for COHA, noted last year:

President Lugo was unable to address land reform because the Colorado Party, whose coalition remains loyal to the landed elite and presides over a majority in the Paraguayan Congress, frequently blocked his land reform legislation, which they consider populist. [37]

If Paraguay were to enter the Pacific Alliance with its current distribution of land and no progress towards land reform, those who currently hold land—agribusinesses and local elites—will continue to reap the benefits of producing for a larger export market. Small farmers and landless peasants, on the other hand, will not have the output capacity nor the resources to keep up with larger landholders competing in a globalized market. The expansion of the mechanized soybean industry that might result from membership in the Pacific Alliance would continue to displace these workers from their land and exacerbate slum conditions in larger cities.

Taxes in Paraguay

Paraguay’s taxation system is ineffective and favors larger companies and landed local elites. It is difficult for poorer segments of the Paraguayan population to live above subsistence level and most of their income is spent on consumption. Nevertheless, four- fifths of tax revenues in Paraguay come from imposts on consumption. This makes for a highly regressive taxation system that exacerbates inequality by placing a large burden on the poor to fund government revenues. Further, the taxation system has failed to effectively garner adequate funds to mitigate poverty in the country. In 2012, tax revenue made up just 18 percent of GDP, a far lower percentage than in neighboring Brazil (37.6 percent of GDP) or Bolivia (46.5 percent of GDP). A May 2012 Oxfam study on Paraguay’s taxation system revealed that:

To a great extent, one of the underlying causes [of unequal land distribution] is tax injustice, characterized by a very low and unstable tax burden, which determines the effectiveness of governance to eradicate poverty and is excessively biased towards indirect taxes on consumption, further increasing the inequality that characterizes Paraguay. [38]

In August 2012, the first ever income tax was implemented by congressional liberals under interim president Federico Franco, but “at just 10% on incomes above 120 times the minimum wage, it is hardly radical.” [39] While the implementation of the income tax does mark a critical and visible improvement in the tax structure, it should be noted that it took more than 10 years for an income tax to be pushed through the Paraguayan legislative bodies. Furthermore, the small size of this tax will hardly alleviate the tax burden on the lower class. This demonstrates that the Paraguayan government is hesitant to bolster government revenues that are supportive of government welfare programs since it fears losing the backing of the business interests that exploit this regressive taxation system.

Another issue in Paraguay is the lack of revenue generated from the taxation of large landholdings. Oxfam notes that “the extremely low [land] taxes often promote the use of land as a form of saving and speculation, a factor which could be directly linked with the maintenance of the unequal distribution of land.” [40] Yet other countries have made progress. In Uruguay on June 12, 2013, the “chamber of deputies approved a bill establishing an ‘estate tax’ (impuesto al patrimonio), to be levied on individuals with land holdings of over 2,000 hectares (ha),” Latin News reported. [41] In Paraguay, where politicians are more conservative than in left-leaning Uruguay, such action would require a significant political change of heart. Still, if the land tax on large landholders were implemented, it could increase government revenues and allow the government to make an effort to decrease inequality. This would also discourage landowners from using land for speculative purposes.

But as it stands, Paraguay’s tax code is riddled with loopholes that are easily exploited by transnational agribusinesses. The Oxfam study indicates that “the IMF calculates that evasion of VAT [Value-Added Tax] in Paraguay stands at between 45 percent and 55 percent.” [42] Some sources, the study adds, have calculated that tax evasion by industries (including agribusinesses) could represent a loss of up to one third of Paraguay’s potential tax income. Because of the transnational nature of agribusiness companies operating in Paraguay, it is difficult for the state to monitor the activities of these companies. Agribusiness is highly vertically integrated and “the larger companies have greater possibilities for tax dodging through conducting transactions between interrelated parties.” [43]

As long as Paraguay’s regressive tax system and tax loopholes are exploited by large, foreign companies, the growth of the soybean industry brought about by the Pacific Alliance will not noticeably contribute to social welfare because the government is unable to tax and regulate the majority of these profitable companies. The Paraguayan tax system, as it is, props up foreign businesses at the expense of domestic consumers and producers—contributing to inequality in the country. A more progressive tax system with no loopholes for larger companies could bring in necessary revenues to mitigate poverty through welfare programs and conditional cash transfers.

A Path Forward

The current government must no longer yield to foreign business interests. Instead it should prove that it can distribute the benefits of its export economy to a larger proportion of its citizens. Until it does so, it makes no sense for Paraguay to join the Pacific Alliance. Without reforming its land distribution policies and its taxation system, membership in the Pacific Alliance would only serve to exacerbate existing inequality by propping up agribusiness while denying the majority of the Paraguayan population the benefits of the country’s export-led growth.

In order to effectively combat inequality, the robust agribusiness sector should be more closely tied with the rest of the Paraguayan economy, while government policy should be reexamined in order to better funnel some of the benefits of GDP growth to the Paraguayan poor. In fact, as Pineo notes, “Industrialization, the core of economic development, came [historically] only with considerable interference with free markets.” [44] The income tax should be raised and land that is currently set aside for speculation should be turned over to the government for purposes of distribution to landless peasants. Small farmers should receive agricultural subsidies so they are not overrun by agribusiness. While a conditional cash transfer program was set up in 2005 and in 2010 offered benefits to 112,000 Paraguayan families, funding for such programs has been hard to come by. [45] The Paraguayan government should close loopholes to increase tax revenues and use these funds to increase the scope of these welfare programs.

For these changes to be made, of course, there must be an end to corruption and cronyism—chronic symptoms of Paraguayan politics for decades. [46] Unfortunately, the Lugo coup and the election of Cartes indicate that this end may not yet be in sight. The enduring power dynamic in Paraguay remains a dismaying example of the political and economic sway that landed business interests continue to hold throughout much of South America. While powerful political forces in the country advocate joining the Pacific Alliance as a way for Paraguay to prove its regional legitimacy, these same forces do not value the needs of the population and likely never will. Only when the government acts independently of pro-business forces can the country at once develop economically and mitigate socioeconomic stratification, thereby progressing to a more equal state.

Brian Drumm and Phineas Rueckert, Research Associates at the Council on Hemispheric Affairs

Please accept this article as a free contribution from COHA, but if re-posting, please afford authorial and institutional attribution. Exclusive rights can be negotiated.

For additional news and analysis on Latin America, please go to: LatinNews.com and Rights Action

References

[1] “Region’s newest growth engine gathers pace,” Latin News, May 24, 2013, accessed July 30, 2013 http://latinnews.com/component/k2/item/56286.html?period=May+2013&archive=3&cat_id=791662%3Aregion%E2%80%99s-newest-growth-engine-gathers-pace&Itemid=6>

[2] Jim Wyss, “In bloc-happy Latin America, the Pacific Alliance hopes to stand out,” Miami Herald, March 22, 2013, accessed July 30, 2013, http://www.miamiherald.com/2013/05/22/3411211/in-bloc-happy-latin-america-the.html#storylink=cpy.

[3] Jim Wyss, “Costa Rica and Guatemala move closer to joining Pacific Alliance,” Miami Herald, March 23, 2013, accessed July 30, 2013, http://www.miamiherald.com/2013/05/23/3413506/costa-rica-and-guatemala-move.html.

[5] “’Pacific Alliance’: a fresh initiative uniting Chile, Colombia, Mexico, and Peru,” INTAL, May 2011, accessed July 30, 2013, http://idbdocs.iadb.org/wsdocs/getdocument.aspx?docnum=36385993

[6] Wyss, “Costa Rica and Guatemala”

[7] Ibid.

[8] “Region’s newest growth engine”

[9] “Avanzan Negociaciones Para Constituir el Fondo de Cooperación de la Alianza del Pacífico,” Agencia Mexicana de Cooperación Internacional Para el Desarrollo, accessed July 30, 2013, http://amexcid.gob.mx/index.php/es/prensa/comunicados/1712-avanzan-negociaciones-para-constituir-el-fondo-de-cooperacion-de-la-alianza-del-pacifico

[10] “Region’s newest growth engine”

[11] “30 Questions on the Pacific Alliance,” Ministerio de Comercio, Industria, y Turismo de la República de Colombia, accessed July 30, 2013, https://www.mincomercio.gov.co/englishmin/publicaciones.php?id=3231

[12] “Socio-environmental impacts of soybean in Paraguay – 2010,” NGO Repórter Brasil, August 2010, accessed July 30, 2013, http://reporterbrasil.org.br/documentos/PARAGUAY_2010ENG.pdf

[13] Ibid.

[14] Ibid.

[15] Jeremy Hobbs, “Paraguay’s Destructive Soy Boom,” New York Times, July 2, 2012, accessed July 30, 2013, http://www.nytimes.com/2012/07/03/opinion/paraguays-destructive-soy-boom.html?src=recg%3E

[16] “Socio-environmental impacts”

[17] Simon Romero, “Boom Times in Paraguay Leave Many Behind,” New York Times, April 24, 2013, accessed July 30, 2013, http://www.nytimes.com/2013/04/25/world/americas/boom-times-in-paraguay-leave-many-behind.html?pagewanted=all

[18] “Socio-environmental impacts”

[19] Romero, “Boom Times in Paraguay”

[20] José Antonio Ocampo, “Small Economies in the Face of Globalisation” (paper presented at the Third William G. Demas Memorial Lecture at the Caribbean Development Bank, Cayman Islands, May 14, 2002).

[21] Romero, “Boom Times in Paraguay

[22] Ronn Pineo, “The Free Market Experiment in Latin America: Assessing Past Policies and the Search for a Pathway Forward,” Council on Hemispheric Affairs, April 17, 2013, Accessed July 30, 2013, https://coha.org/the-free-market-experiment-in-latin-america-assessing-past-policies-and-the-search-for-a-pathway-forward-part-three-the-last-of-three-parts/.

[23] “Socio-environmental impacts”

[24] Fernando Martínez Escobar, “Paraguay – the ‘poverty factory,’” May 7, 2013, accessed July 30, 2013, http://lab.org.uk/paraguay-the-poverty-factory

[25] Pineo, “The Free Market Experiment”

[26] “Paraguay,” International Monetary Fund Country Report, July 15, 2011, accessed July 30, 2013, http://www.imf.org/external/pubs/ft/scr/2011/cr11239.pdf

[27]Forbes, “Paraguay,” accessed July 30, 2013, http://www.forbes.com/places/paraguay/

[28] “World Bank Indicators – Paraguay,” Trading Economics, accessed July 30, 2013, http://www.tradingeconomics.com/paraguay/poverty-headcount-ratio-at-rural-poverty-line-percent-of-rural-population-wb-data.html

[29] Cristiano Morsolin, “Fernando Lugo’s Exit after Paraguay ‘Coup’ a Setback for Development,” The Guardian, June 29, 2012, accessed July 30, 2013, http://www.guardian.co.uk/global-development/poverty-matters/2012/jun/29/fernando-lugo-paraguay-coup-development

[30] Eric Stadius, “Land Reform Issues Intensify as Paraguay Enters into a Political Crisis,” June 22, 2012, accessed July 30, 2013, https://coha.org/land-reform-issues-intensify-as-paraguay-enters-into-a-political-crisis/

[31] Peter Orsi, “Land Reform, Paraguay’s Ticking Political Bomb,” June 29, 2012, accessed July 30, 2013, http://bigstory.ap.org/article/land-reform-paraguays-ticking-political-bomb

[32] “Socio-environmental impacts”

[33] Romero, “Boom Times in Paraguay”

[34] Pineo, “The Free Market Experiment”

[35] “Paraguay,” Encyclopedia Britannica, accessed July 30, 2013, http://www.britannica.com/EBchecked/topic/442637/Paraguay/27980/Manufacturing

[36] Jonathan Gilbert and Jonathan Watts, “Horacio Cartes Wins Paraguay Election,” April 21, 2013, accessed July 30, 2013, http://www.guardian.co.uk/world/2013/apr/22/horacio-cartes-wins-paraguay-election

[37] Stadius, “Land Reform Issues Intensify”

[38] Déborah Itriago, “Taxation in Paraguay: Marginalization of Small-Scale Farming,” Oxfam Research Reports, May 2012, accessed July 30, 2013, http://www.oxfam.org/sites/www.oxfam.org/files/rr-taxation-paraguay-smallscale-producers-24052012-en.pdf

[39] H.J. and M.L., “Paraguay’s Election: Back to the Past,” The Economist, April 22, 2013, accessed July 30, 2013, http://www.economist.com/blogs/americasview/2013/04/paraguays-election

[40] Itriago, “Taxation in Paraguay”

[41] “Region’s newest growth engine”

[42] Ibid.

[43] Itriago, “Taxation in Paraguay”

[44] Pineo, “The Free Market Experiment”

[45] Morsolin, “Fernando Lugo’s Exit”

[46] Ibid.